The last year has seen many shake-ups to the advertising world; big platforms shutting down, Google losing multiple advertising-related court cases, and the ever-evolving machinations of MFA. One thing that doesn’t change is the Genius Monkey platform’s ability to reach your audience: any audience!

Genius Monkey users represent a vast variety of verticals across multiple programmatic channels. We’re always talking about following the data; let’s see what the data has to say! Join us as we analyze the Genius Monkey programmatic trends and highlights across the last year.

Display: The Bread and Butter is Getting Better

Overall

Averaging across many verticals, display advertising has increased marginally in price, but greatly in placement quality; the average cost-per-click (CPC) has increased about 4.5%, while click-through-rates (CTR) have increased by 57.8%! Even though advertisers are paying a little more to place their ads, these numbers suggest those placements are growing increasingly effective at engaging their intended audience.

Vertical Highlights

We’ve also seen some great trends among individual verticals within display ads. Business services display CPCs have decreased about 15% from $1.02 to $0.86, while the Energy vertical observed display CPMs that dropped 30% from $1.05 to $0.81!

CPCs for the entertainment, non-profit, and beauty verticals have remained stable since last year, showing only marginal changes. Even with the price holding steady, the click-through rates have improved; entertainment by 30%, nonprofit by 37%, and beauty by 41%!

The award for the best improvement in display click-through rate belongs — unsurprisingly — to the tech vertical, with CTR increasing a whopping 45% YoY.

Cost-per-thousand-impressions (CPM) have increased across the board for every vertical; as more advertisers recognize the power of programmatic, more are entering the market and demand for inventory is increasing. This highlights the need for advertisers to approach digital programmatic with an effective strategy; attempting to out-spend the competition will just leave budgets and teams exhausted.

Across 2024, Genius Monkey has improved the display CTR of nearly every vertical, out-pacing the rising costs with increased engagements. Better engagements lead to higher-quality and longer-lasting conversions, directly linking your advertising efforts with increased revenue and efficiency. Modern technology allows any advertiser to place an ad, but a savvy marketer follows the data to place it effectively.

Video: Ever-increasing Inventory

Video has been regarded for some time as the programmatic channel with one of the highest potential ROAS when blended with an effective display campaign, and publishers are more than happy to provide inventory to meet – and in some cases exceed – advertiser’s demand. Average video CPC has decreased by about 4% from $0.91 to $0.87, while CPM decreased about 11% from $15.66 to $13.96. Average video CTR remained fairly steady, only decreasing by about 2%.

The overall trend is decreasing prices with relatively stable engagement since Q1 2024. This suggests that more and more video inventory is hitting the market which is driving down prices as less-expensive inventory is opening up. The Beauty vertical saw the biggest improvements, with a massive decrease in CPC of 75% from $1.59 to $0.41. Beauty CPM also decreased by about 23%, while the CTR increased by around 18.5%.

As we have seen steadily since Covid, the Tourism/Travel vertical has continued to show excellent engagement with a CTR that nearly quadrupled since 2024. Home Services saw a 68% increase in CTR, while Non-profits enjoyed a 28% decrease in CPM. The Entertainment vertical was another great highlight; CTR increased by about 26.5% while CPM decreased by about 34%.

As video inventory continues to flourish, Genius Monkey expects that prices will continue to decrease as video finds its footing in a competitive market.

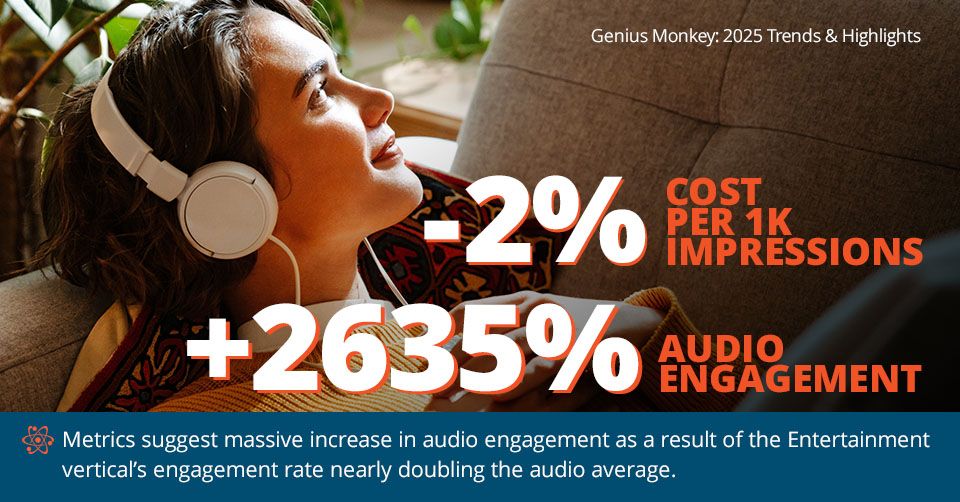

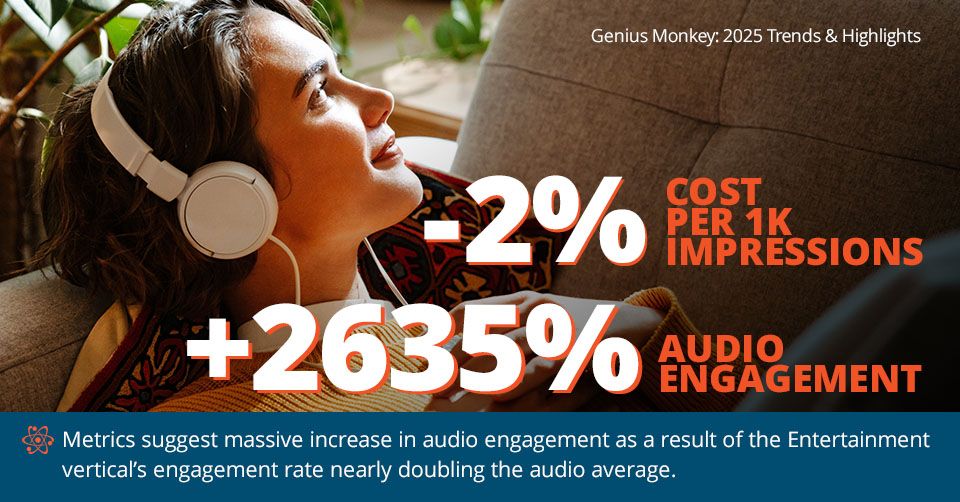

Audio: Stable Prices and Explosive Engagement

While much more niche than display ads, audio is an underappreciated gem that continues to insert naturally into the day-to-day of consumers. Average CPM across all verticals has slightly decreased by 2% from $25.96 to $25.46, but the engagement for Genius Monkey users has skyrocketed.

Our metrics suggest that audio engagements (longer listens, clicking on companion banners, or engaging post-ad behavior) have jumped up by 2635%! This gigantic increase is likely thanks to the Entertainment vertical, which turned in an engagement rate nearly double the audio average.

The relatively stable prices suggest that audio inventory and advertisers demand aren’t drastically changing, yet audiences are paying much more attention compared to last year. Is programmatic audio the next big thing in programmatic advertising? Check out this article to learn more about the flexibility of modern audio ads.

CTV: Evolving Technology Offering Newer Metrics

No other channel has enjoyed as many technological improvements as OTT/CTV, which has continued its climb as the fastest-growing programmatic medium. New techniques are now finally making it possible to measure click-through rates, view-through rates and more, so there’s little to compare against Q1 2024.

One highlight can be found in the Legal vertical, where CPM has decreased dramatically. Since 2024, Legal CTV CPM has decreased by nearly 51%, dropping from $38.92 (already below the industry average) to $19.13. Prices may fluctuate as CTV continues to define its place in modern media, but we expect with time, tech, and experience, Genius Monkey users will soon see improved engagement rates through OTT/CTV.

And the industry at large seems to agree; since Q1 2024, many large companies and streaming services have heavily invested in ad-supported streaming.

- Disney bought out their would-be plaintiffs Fubo TV and merged their sports broadcasting with Hulu

- Netflix has constructed its own ad platform from scratch to service its rapidly-growing ad-supported tier

- Skydance Media bought Paramount Global, merging Paramount+, CBS, Pluto TV, and several other brands into one streaming umbrella

- Roku acquired FrndlyTV, adding yet another app for users to access through their Roku devices

- While the super-app “Venu” never came to be, Fox and ESPN (owned by Disney) are still joining forces to bundle sports streaming into “Fox One”, launching in October 2025

Genius Monkey has been beating this drum for some time: CTV is expanding and quickly becoming the “next big thing” when it comes to programmatic advertising. Advertisers would do well to consider how they can smartly incorporate a CTV component into their marketing strategy; if you’re not sure where to start, then it just might be the right moment to come talk with the experts!

Why Every Medium is Important

An advertiser might read a report like this and wonder why they should bother with multiple mediums. Display is the cheapest and is showing great improvements, so why not exclusively run display campaigns?

The magic of programmatic (and indeed the Genius Monkey platform) is the ability to appear in front of a customer at exactly the right time and place. Display is awesome, but display ads can’t appear everywhere; you need the other mediums to maximize exposure and dramatically increase chances of conversions. Price drops and increasing engagements are only possible through multi-faceted campaigns that leverage the strengths of each medium and carefully lead the consumer down the funnel.

Every channel plays an important role, and users of the Genius Monkey platform have the unique ability to see exactly how each medium contributes to the customer journey. Our industry-leading conversion reports allow you to tailor the funnel to your audience, optimizing the perfect balance of mediums, placements, and timing.

Sound too good to be true? Well, that’s what you get with a data-driven platform supported by hands-on experts. If you’re ready to see the Genius Monkey difference, get in touch with us today to begin evolving your marketing strategy to the next level!